The annual run rate is a metric that a lot of teams find themselves pursuing. But when you look at it closely, it’s surprising how limited the applicability of the run rate is — and how off-base this metric can be if taken at face value.

Predicting future performance is an important part of building a productive sales plan for your company. Forecasting allows you to prioritize certain aspects of your business, cut costs on whatever you need, and implement forward-looking strategies.

However, a team should always keep in mind that successful evaluation of future performance requires the most accurate data on hand. Even more important is to set an approach that provides realistic forecasts.

Run rate is none of those things.

It’s a notoriously inaccurate metric, which is easily manipulated, and which rarely provides dependable analysis. It has its use, but before you make run rate a part of your sales plan, it’s imperative to understand the drawbacks of this method.

Let’s define the annual run rate

Annual Run Rate (ARR) is a common metric sales teams use to predict the revenue of their organization over the next 12 months. It allows teams to quickly estimate how much they are going to earn in a year and use that data to their advantage.

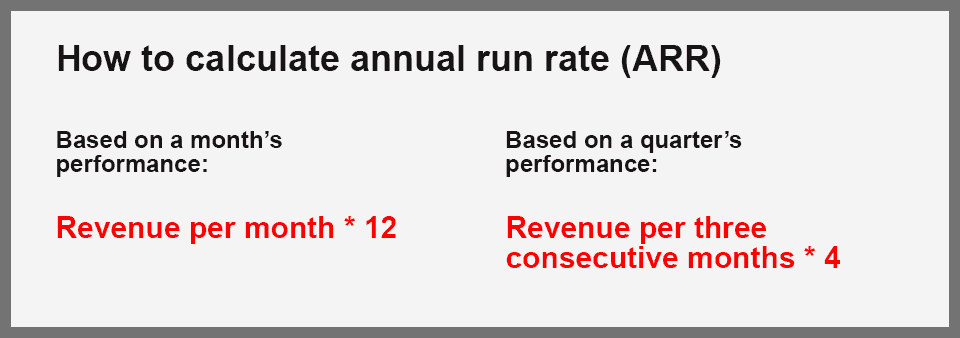

Run rate is calculated based on a monthly or quarterly performance of a company:

The problems with run rates

This forecasting method works best for SaaS companies and other types of businesses that sell a recurring subscription. Run rate allows such companies to predict incoming revenue in situations when there is no other data available.

The more dependable a business’s revenue flow is, the more accurate ARR gets. However, this is the point at which this metric becomes inherently flawed, as a company’s revenue rarely stay the same month to month due to a variety of reasons.

1. ARR doesn’t take into account seasons, product releases and other events

As annual run rate takes a single month’s (or quarter’s) revenue and extrapolates it on the rest of the year, it’s tied to the assumption that the revenue will stay the same throughout a 12-month period.

But as we’ve stated above, that’s almost never the case.

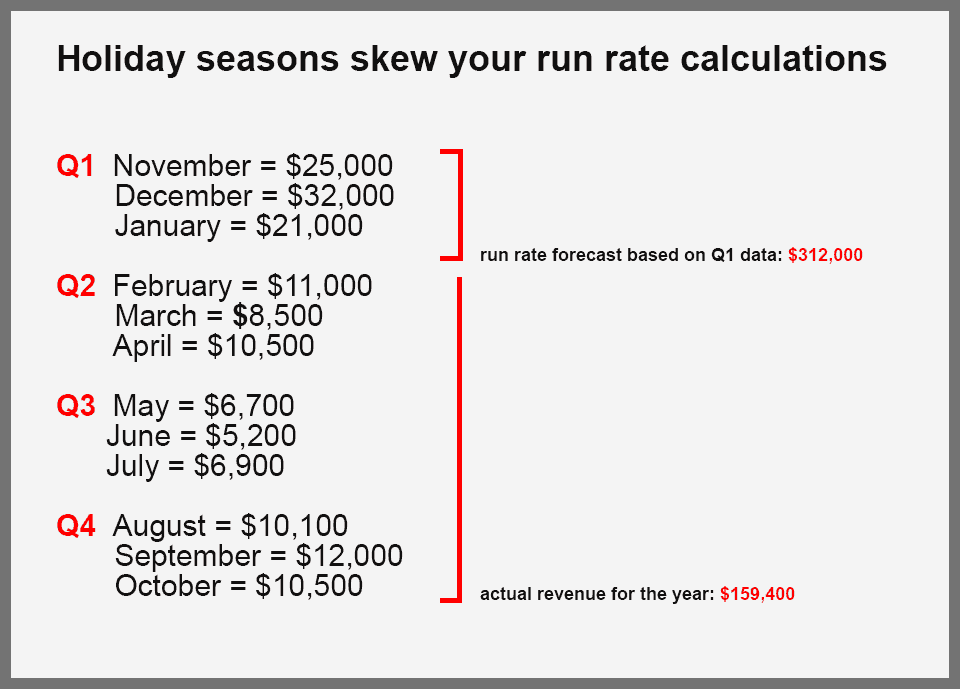

Holiday sales and other seasonal events are an obvious example of how run rate calculations fail to deliver a dependable prediction. A lot of companies run deals and promotions during holidays, with some (like gift stores) achieving peak performance during the same months each year (for example, in December, during Christmas holidays).

Obviously, if you’re a part of a sales team for a gift store, and you take December sales into account for your ARR calculations, the forecast for the rest of the year is going to be overly optimistic.

And this happens even if you calculate run rate by quarter performance:

The obvious solution would be to exclude December and other holiday seasons from the equation. This will results in a more conservative ARR estimate, which you can manually adjust to include holiday revenue later.

However, this approach still doesn’t include a lot of other time-sensitive events that can have a significant impact on your sales. For example, pop culture events, like blockbuster premieres, can hugely drive sales of related merchandise. ARR also doesn’t factor in product release and feature updates, both of which can influence your performance.

2. Your ARR calculations are easily skewable

Imagine that you’re selling $99 subscriptions and your monthly revenue averages $20,000. But before the end of the month, you succeed in bringing a big customer on board, and your revenue for the month is suddenly $30,000.

There’s a huge incentive to include that data in run rate calculations, as it will highlight that your company is growing.

But by using this data to build predictions, you are at risk of kneecapping your own growth strategy. An overblown run rate can contribute to poorly distributed budget, inaccurate decisions, or unrealistic performance expectations which will sink the motivation of your team.

On the one hand, the obvious solution to this problem would be excluding an anomaly purchase from your ARR prediction. But this runs the problem of creating a too conservative forecast, which (when taken too seriously) can prevent you from allocating necessary resources to developing new features, investing in new tools and/or raising the salaries of your employees.

In the long run, this can thwart your company’s growth.

3. It’s based on partial data

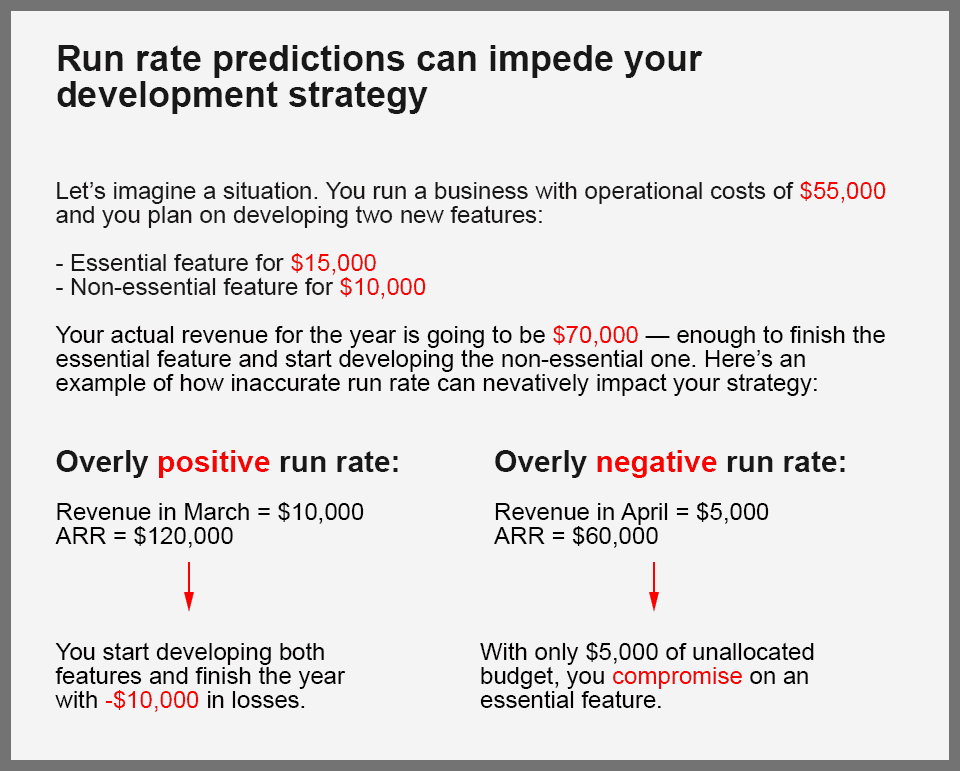

From the previous points we’ve raised, it should become obvious that ARR can give you wildly different results based on the period you are extrapolating. The nasty side effect of this approach is that the run rate tends to provide either an overly positive, or an overly negative forecast, both of which can disrupt your sales strategy.

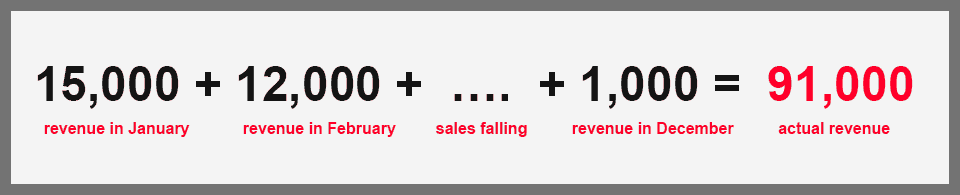

The root of the problem is the partiality of data used for run rate calculations. For example, imagine that you begin the year this way:

- January: $15,000

- February: $12,000

- March: $11,000

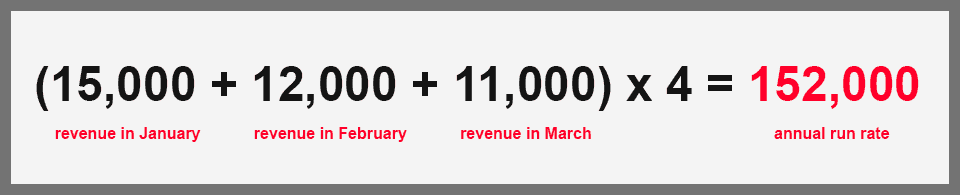

Calculating quarterly ARR gets you to $152,000 as your predicted revenue for the year.

But you can see that the sales in this quarter are actually falling. If they continue to fall by $1,000 each month, your actual revenue for the year is going to look a lot different:

However, a decrease in sales during the first quarter doesn’t necessarily mean that it’ll continue for the rest of the year. It can be a seasonal fluctuation, a side effect of restructuring, etc.

What this means is that the data used to build an ARR prediction is too partial to be useful. Before building an ARR model you would need to understand if your sales are actually falling or not. Injecting ARR data into your sales plan for the rest of a 12-month period will only result in mistakes.

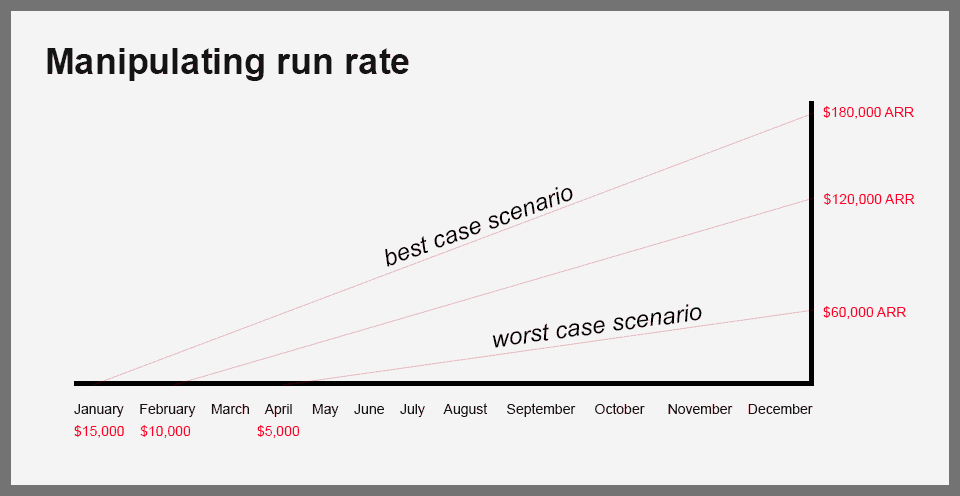

4. It fails to factor in growth

The thing about business growth is that it tends to attract more growth. And that growth curve can be exponential. Which means that in the early stages you may add a very small amount of users each month, but after you reach a certain level those users could double or triple very quickly.

Obviously, a linear approach to run rate doesn’t take this kind of growth into account. Which means that if your sales strategy is locked in because of outdated run rate data, you might not take advantage of the influx of new users — because of the limited size of the sales department.

5. ARR doesn’t hold up to scrutiny

The not-so-well-kept secret of annual run rate calculations is that it’s easy to make them look good.

Take a month which was particularly favorable to your business, multiply it by 12 — and boom, you have a forecast predicting an amazing year of revenue. You can now use this prediction in talks with investors or in marketing. But should you?

Experts know how deceiving the run rate metric is. A single month of good revenue (or even a quarter) doesn’t prove that your business will hold up in the long run, and the opposite can be true too.

That’s why if you’re planning to present your run rate data during a meeting, be sure to complement it with hard, accurate and more reliable data that supports your forecast (see rule of 78).

Otherwise, you can encounter some very tough questions you won’t be able to answer.

Side note: MRR makes run rate smarter

After reading all our points it may be tempting to think that run rate has no value for a business. That’s not the case. With adjustments and modifications, ARR calculations could be a helpful way to better allocate budget and understand your current financial situation.

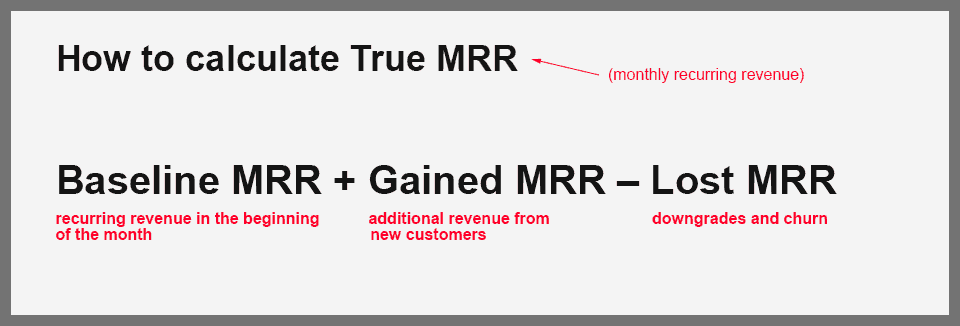

Experts recommend basing your run rate on true MRR (short for monthly recurring revenue).

Propeller CRM recommends using this formula to calculate your true MRR:

You can then proceed to multiply true MMR by 12 to achieve a more accurate annual run rate. However, even with such an approach, you should strive to take into account feature updates, seasonal sales, and other unpredictable events.

Conclusions

Run rate is a tempting metric, but business owners should always approach it with caution. It deals with partial data, which means that ARR calculations often produce inaccurate forecasts. Basing your sales strategy solely on run rate predictions will significantly weaken it.

As always, we’re looking for your feedback — if you have additional thoughts, or if your business successfully uses annual run rate forecasts, be sure to leave a comment below!

Leave a Reply